Bank of America Closing: 5 Critical Lessons for the Future

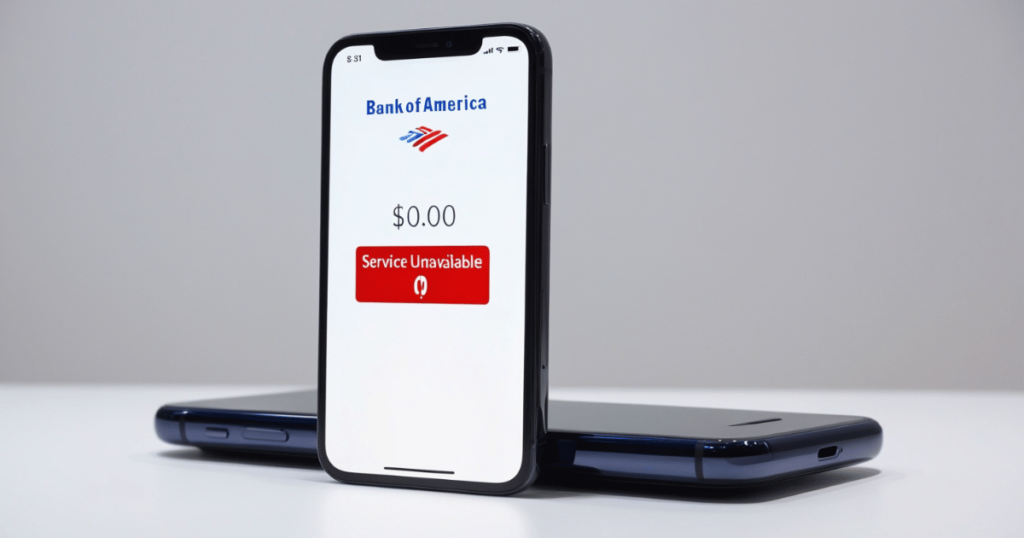

On October 2, 2024, Bank of America closing operations sent shockwaves throughout the financial industry and caused panic among millions of customers. A technical failure in the bank’s systems led to a widespread outage that zeroed out account balances and prevented access to essential banking services. The unexpected Bank of America closing event affected both individuals and businesses across the nation, highlighting vulnerabilities in the bank’s technological infrastructure.

In this comprehensive guide, we will explore the Bank of America closing, discuss the root causes of the outage, analyze the impact on customers and businesses, and evaluate the long-term effects on the bank’s reputation. Additionally, we will discuss how this could lead to increased regulatory scrutiny and what this means for the future of digital banking.

Overview of the Bank of America Closing

The Bank of America closing on October 2, 2024, left customers in a state of confusion and anxiety as they were suddenly unable to access their accounts. Many logged into their online or mobile banking only to discover that their balances were set to zero. In some cases, customers were completely locked out of their accounts, unable to perform any transactions or check their balance.

This Bank of America closing caused a nationwide panic, especially as more customers began to experience the issue. Businesses, individuals, and corporate clients all experienced disruptions, with delayed payments and transfers resulting in critical financial complications.

What Led to the Bank of America Closing?

The root cause of the Bank of America closing appears to have been a technical failure, though the bank has yet to release a full report on the issue. Preliminary information suggests that a software update in the bank’s core processing system may have malfunctioned, causing widespread system outages.

Experts believe that the failure was likely due to an issue with payment processing systems, which handle billions of dollars in transactions daily. These systems are highly complex and rely on intricate layers of infrastructure that, when disrupted, can trigger massive outages like the one witnessed during the Bank of America closing.

The problem may have also been related to aging infrastructure, which is often susceptible to errors during updates or maintenance. Financial institutions rely heavily on seamless coordination between multiple systems, and a failure in any one part of the chain can lead to disastrous outcomes, as seen during the Bank of America closing.

Cybersecurity Concerns During the Bank of America Closing

Although Bank of America confirmed that the closing was due to a technical error rather than a cyberattack, many customers feared that their data or funds may have been compromised. Given the increasing frequency of cyberattacks on major financial institutions, any system failure naturally leads to concerns about security breaches. While Bank of America has assured customers that their data was safe, the Bank of America closing has brought the bank’s cybersecurity measures into question.

The Impact of the Bank of America Closing on Customers

Individuals Affected by Bank of America Closing

For millions of individual customers, the Bank of America closing was a severe disruption to their daily lives. Many rely on their accounts to pay bills, buy groceries, and manage essential expenses. The sudden disappearance of funds caused widespread panic, especially among those who were living paycheck to paycheck.

Some customers expressed frustration at the closing, especially given that this was not the first time Bank of America had faced technical issues. As the situation unfolded, social media became flooded with posts from anxious customers who shared their experiences and vented their concerns about the outage.

Business and Corporate Disruptions

The Bank of America closing didn’t just impact individual account holders. Small businesses, large corporations, and even nonprofits that use Bank of America for payments or payroll services experienced severe delays and disruptions. Payments to vendors and employees were delayed, causing financial strain for many companies.

For businesses that rely on Bank of America closing for critical operations, the outage represented a serious threat to their ability to function smoothly. Companies missed deadlines for bill payments and experienced significant delays in processing transactions. For some businesses, the Bank of America closing had ripple effects that extended beyond the day of the outage, as delayed payments caused further complications down the line.

Social Media Uproar and Customer Responses

The Bank of America closing triggered an uproar on social media, with Twitter and Facebook becoming hotbeds for real-time updates, customer complaints, and even humor about the situation. Some customers posted screenshots of their zeroed-out account balances, while others tagged the official Bank of America account, demanding answers.

Within hours of the closing, the situation had escalated, as news outlets picked up on the story and spread it further. The volume of customer complaints made it clear that the Bank of America closing had far-reaching consequences, impacting millions of people across the nation.

Bank of America’s Response to the Closing

Initial Response from Bank of America

In the early hours of the Bank of America closing, the bank’s communications were slow to address customer concerns. Initially, Bank of America posted a brief message on its social media channels, acknowledging the issue and assuring customers that they were working on it. However, the message lacked specific details and offered little reassurance to those affected by the closing.

It wasn’t until later in the day that Bank of America released a more comprehensive statement. They explained that their technical teams were working diligently to restore account balances and resolve transaction delays. The bank reassured customers that their funds were safe and that normal operations would resume as soon as possible.

Delays in Customer Support

Despite Bank of America’s efforts to address the closing, many customers reported long wait times and unhelpful responses from customer service. The overwhelmed customer service teams struggled to handle the flood of inquiries, leaving many customers feeling neglected. This lack of communication only deepened the sense of frustration surrounding the Bank of America closing.

Although services were largely restored by the end of the day, many customers were still left with lingering questions about the cause of the closing and whether their trust in the bank had been irreparably damaged.

Long-Term Impacts of the Bank of America Closing on the Bank’s Reputation

Bank of America’s History of Technical Failures

The Bank of America closing on October 2, 2024, was not an isolated incident. The bank has experienced several significant outages over the past decade, each time eroding customer trust and raising questions about the reliability of its technology. As more customers demand seamless and reliable digital banking services, repeated failures like the Bank of America closing could cause many to look for alternative financial institutions.

With increased competition from fintech startups and traditional competitors that prioritize technical stability, Bank of America may face a significant loss of business unless it addresses the underlying issues that led to the closing.

Impact on Investor Confidence

In addition to customer dissatisfaction, the Bank of America closing may also have a negative impact on investor confidence. Earlier this year, Berkshire Hathaway, Warren Buffett’s investment firm, sold off a substantial portion of its Bank of America stock, raising concerns about the bank’s future performance. While the reasons behind the sale are speculative, the closing has only added fuel to the fire.

Investors will be keeping a close eye on Bank of America as it works to rebuild its reputation and reassure shareholders that such outages will not become a recurring problem.

Lessons for the Financial Industry from the Bank of America Closing

The Importance of Infrastructure Resilience

The Bank of America closing highlights the importance of maintaining resilient and reliable infrastructure within the financial industry. As more customers move toward digital banking, even minor system failures can have a profound impact on customer trust and the broader financial system. The Bank of America closing should serve as a wake-up call for other institutions to invest in the stability of their systems.

Increased Regulatory Scrutiny

The Bank of America closing is likely to attract the attention of regulatory bodies like the Federal Reserve and consumer protection agencies. As financial institutions face stricter standards for operational stability, incidents like the Bank of America closing could lead to more stringent regulations around system maintenance, customer communication, and transparency during outages.

The Federal Reserve and other authorities may conduct investigations to determine whether Bank of America’s systems were adequately maintained and whether the bank’s response to the closing was sufficient.

What Can Customers Do to Protect Themselves in the Future?

Diversify Banking Options

One lesson customers can take from the Bank of America closing is the importance of diversifying their banking services. Relying solely on one financial institution can leave customers vulnerable to outages and system failures. By spreading accounts across multiple banks, individuals and businesses can reduce the risk of being entirely cut off from their funds during a closing.

Monitor Accounts Regularly

Another key takeaway from the Bank of America closing is the importance of closely monitoring account activity. Customers should frequently check their balances and transaction history for any irregularities, especially during periods of system failures or service disruptions. Utilizing financial apps that track multiple accounts can provide an added layer of protection and insight into overall financial health.

The Future of Digital Banking After Bank of America Closing

The Bank of America closing is a reminder that even the largest financial institutions are not immune to technical failures. As the banking industry becomes more reliant on digital systems, the risk of outages like the Bank of America closing is ever-present. However, this also presents an opportunity for banks to improve their infrastructure and prevent similar events from happening in the future.

Going forward, banks will need to invest heavily in cybersecurity, system redundancies, and customer service to avoid damaging outages. Technologies like blockchain could also play a role in reducing the likelihood of systemic failures by improving the resilience of financial networks.

Conclusion: Lessons from the Bank of America Closing

The Bank of America closing on October 2, 2024, was a significant event that exposed vulnerabilities in the bank’s infrastructure and raised concerns about the future of digital banking. Customers and businesses alike were impacted by the outage, leading to widespread panic and dissatisfaction with the bank’s handling of the situation.

As financial institutions continue to navigate the complexities of the digital age, the lessons from the Bank of America closing should not be ignored. Improved infrastructure resilience, better customer communication, and diversified banking options will be key to preventing similar disruptions in the future.